Common Questions

The Value Of The Due Diligence Period

Often occurring for an average of 60-90 days after the signing of the initial contract, the due diligence phase is a critical time in the process of buying a commercial property. The Due Diligence Period is the time given to the buyer to fully inspect the property and secure financing. During this period, many of…

Read MoreThe CAP Rate

A Cap Rate or Capitalization Rate is a rudimentary way of calculating an investment property’s return. A Cap Rate, or Capitalization Rate, is a commonly used metric to analyze an income-generating real estate investment. It is defined as a percentage that relates the price of an income-generating property to one year of its future income,…

Read MoreDifferent Types Of Leases

While leases can vary widely from one property to the next, there are several types of leases which are commonly found in commercial real estate. Since every lease can be different, the most important things for a tenant and landlord to understand are which expenses are covered in the lease and which are excluded. Before…

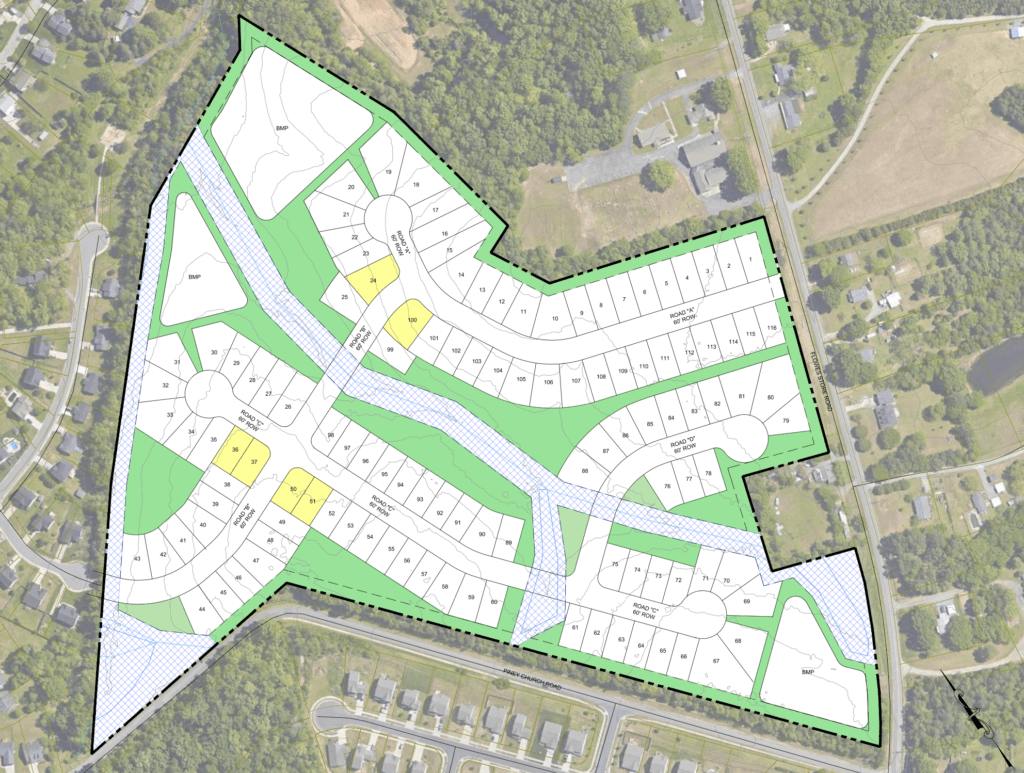

Read MoreFactors that determine the value of Land

One of the first items to consider is the type of zoning. Understanding if the property is zoned for industrial, retail, general business use, high/low density residential, or if a combination of several blended together will often shape the “highest and best use” for a piece of land. In some cases, a specific use or…

Read MoreWho pays the commercial broker?

Typically, the commercial broker is compensated by the property owner but on the rare occasion that the owner refuses to pay and the broker is representing the buyer or the tenant then we can seek compensation directly from them.

Read More