Posts Tagged ‘real estate’

The Value Of The Due Diligence Period

Often occurring for an average of 60-90 days after the signing of the initial contract, the due diligence phase is a critical time in the process of buying a commercial property. The Due Diligence Period is the time given to the buyer to fully inspect the property and secure financing. During this period, many of…

Read MoreThe CAP Rate

A Cap Rate or Capitalization Rate is a rudimentary way of calculating an investment property’s return. A Cap Rate, or Capitalization Rate, is a commonly used metric to analyze an income-generating real estate investment. It is defined as a percentage that relates the price of an income-generating property to one year of its future income,…

Read MoreLeasing Versus Owning Commercial Real Estate

When considering whether to lease or own commercial real estate, there is one simple question for every business owner to understand: Where does your capital earn its greatest return? Understanding whether your capital earns a greater return in your business or in a potential real estate investment will help you to determine where to place…

Read More1031 Exchanges – How And Why?

How can the 1031 Exchange affect the decision to sell? The following is a hypothetical example designed to illustrate why a 1031 exchange would be worth considering: Let’s say Mary’s family has owned a 100-acre farm for more than one generation. Selling land can be a tough decision for a family, but this example can…

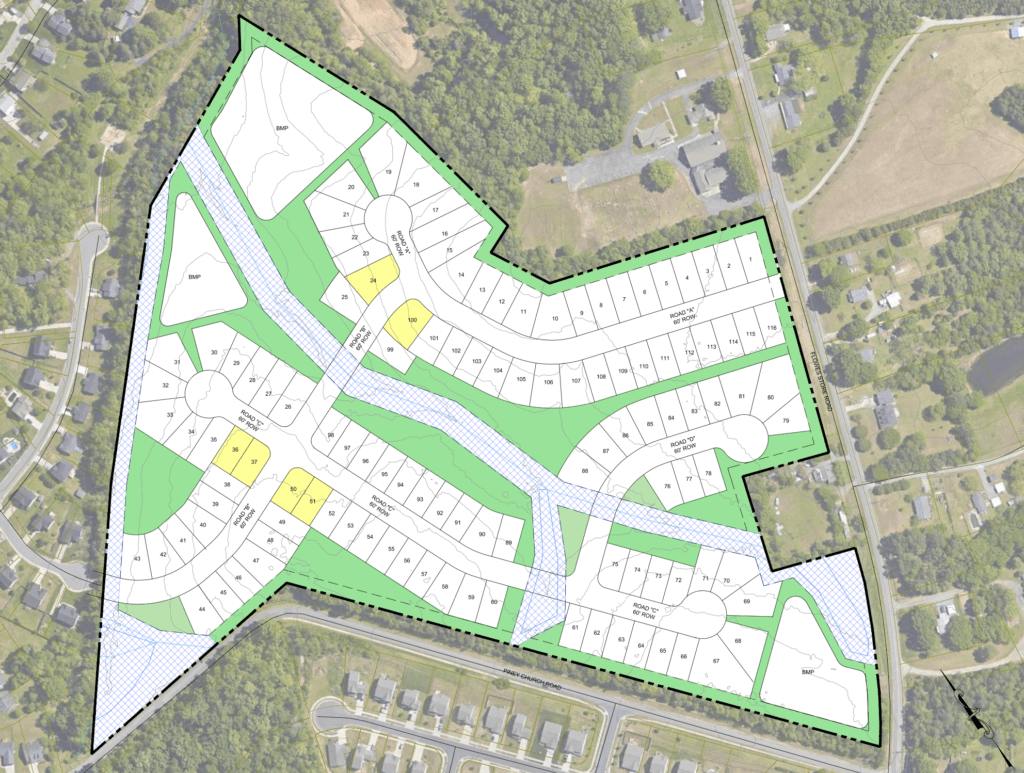

Read MoreFactors that determine the value of Land

One of the first items to consider is the type of zoning. Understanding if the property is zoned for industrial, retail, general business use, high/low density residential, or if a combination of several blended together will often shape the “highest and best use” for a piece of land. In some cases, a specific use or…

Read More